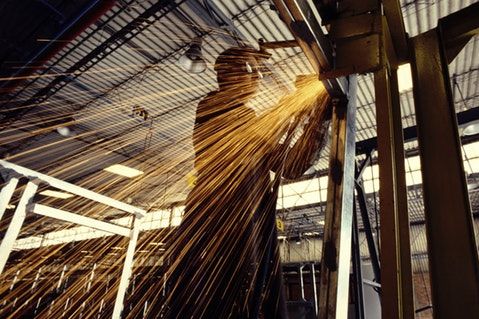

Manufacturers Insurance

from Wagner Insurance Agency

We Know Your Business

Whether your business manufactures moderate to heavy equipment or component parts for the manufacturing or service industries, you have very specific needs in terms of the materials you use ... the processes you employ ... and the business insurance you purchase. We make it a priority to research your business. This research provides us with the knowledge to develop a commercial insurance program that addresses the economic, environmental and safety exposures that your business faces every day. We know your business.

Our Capital Equipment Manufacturers Program is sponsored by the Association for Manufacturing Technology and it is more than just an insurance policy. With it comes a multitude of programs and services designed to save you time and money.

Specialized Coverage

- Boiler & Machinery. This comprehensive form provides coverage for the mechanical breakdown of equipment used in the production of capital equipment. Mechanical breakdown can affect heating and cooling equipment, motors, compressors and other machinery essential to the production process. Additionally, our boiler and machinery form covers electrical injury to transformers, bus bars and associated wiring. In addition to physical equipment damage, the resulting loss of income may be covered.

- Domestic & Export Credit. Domestic export credit insurance provides protection for accounts receivable against bad debt loss from sales arising out of merchandise shipped or services rendered. Credit insurance enables a company to extend larger lines of credit that will translate into increased sales. Since receivables are insured, companies can offer open credit terms without taking undue risk, which can provide a distinct marketing advantage. Program participants can also take advantage of a collection service that can prevent past due amounts from turning into bad debts. Due to the specialized nature of this coverage, ask us for more information.

- International Exposures. Economic, technological and political changes have made the global marketplace a business reality. Many capital equipment manufacturers have begun to take advantage of the opportunities presented by developing operations and/or exporting product to countries around the world. Securing the appropriate coverage for international exposures is essential. Our Worldwide policies, specializes in customized insurance programs for exposures outside the United States. Coverage available includes commercial general liability, property, commercial auto, voluntary workers' compensation and boiler & machinery. Capital equipment manufacturers will find that we have the experience and expertise to create specialized coverage to satisfy unique insurance exposures. For example for product liability suits filed in countries other than the United States. In addition to comprehensive coverage, we also makes available reliable risk management services, sophisticated loss control expertise and fair, fast claim handling.

- Intermodal Transit Coverage. The export market offers capital equipment manufacturers of all types tremendous opportunities. Shipping your product internationally by ocean or air transport creates unique exposures. We can offer a specific set of tailored marine coverages that provide protection for exposures created while your goods are in transit. Coverage options range from named perils (stranding, sinking, collision, etc.) to all risks of physical loss or damage from external causes. You can also purchase protection for cargo temporarily stored in a warehouse.

- Manufacturers Selling Price. This coverage endorsement protects the profit you would have realized if the finished stock had not been damaged by a covered cause of loss. Stock is covered at its selling price (less any discounts or expenses incurred in the sale of the product).

- Limited Pollution Liability. Some of your business operations could result in the accidental release of pollutants. This coverage protects you from bodily injury, property damage and clean-up costs on a third party basis for sudden and accidental incidents on premises or job site that begin and end within a 72 hour period.

- Underground Storage Tank Liability. This stand alone claims made policy provides third party coverage for losses that result from accidental release of pollutants from an underground storage tank or from an incidental above-ground storage tank.

Property Coverage

- Commercial Property. We realize that you have invested a great deal in your business. Therefore, it is important to secure proper protection against loss. Commercial property coverage will protect your inventory, buildings, and their content s from fire, lightning, vandalism and other perils. You have the option of selecting an "all risk" coverage that provides protection from a broader range of perils.

- Inland Marine. Inland marine protects your personal property in or on a motor vehicle that you own, lease or operate. It provides coverage for all covered perils, plus flood, earthquake, collision, overturn, collapsing of bridges, culverts or docks as well as limited loss by theft. In addition, it covers specific classes of property while away from premises.

- Business Loss of Income. If a fire or other covered peril forces you to close your doors, this valuable coverage will help compensate you for the money your business would have earned. Ask us for the specific situations that apply to this coverage.

- Commercial Crime. Nobody likes to think of it, but your business could be the victim of a crime. With this coverage, your business assets are protected against embezzlement, burglary, robbery and theft.

Liability Coverage

- Commercial General Liability. Today's liberal court decisions and sky-high jury monetary awards make liability protection essential. Every business needs this type of protection - we can help you decide how much coverage is right for you. Product liability coverage and incidental design services are included.

- Commercial Auto. Accidents, unfortunately, do happen. Protect your vehicles from collision damage under our business insurance program. Liability for bodily injury and property damage is also included.

- Workers' Compensation. When an employee is injured on the job, everyone loses. For most locations outside Ohio, Your business insurance program provides you with standard workers' compensation as well as employers' mandatory liability coverage, so you and your employees are protected.

- Commercial Umbrella. Commercial umbrella coverage takes over where your regular business insurance leaves off - providing an extra layer of business liability coverage against catastrophic loss.

- Safety Group Dividend. This program always works hard to save you money - and sometimes we even give you some back. Here's how the safety group dividend works. When you purchase business insurance under this program, you become part of a "safety group" of other insured industrial machinery manufacturers. If you and other program participants keep claims low, you earn back a portion of your premium in the form of a dividend. (Dividends cannot be guaranteed and are payable upon declaration of the under writing companies' board of directors.)

- Professional Claims Service. We are committed to giving our customers fair and responsive claims service. Each and every employee is dedicated to giving you friendly, efficient, quality assistance. Our employees have the state-of-the art equipment they need to respond to you more quickly - and they take the initiative to find creative solutions to your insurance problems.

- Professional Loss Control. Our Property Protection Program is a comprehensive program of services designed to help you reduce losses. Loss control specialists work together with you t to reduce the potential for loss of property, capital and life.

- Fraud Control. Why should your premium pay for other people cheating on claims? Our underwriters combat fraud to help keep your insurance program affordable. In recent years, one of our underwriters (CNA) has saved its customers more than $100 million per year in fraudulent and inflated claims.

Get a

Get a